The recent trend has been more dramatic. 50% more people are paying higher rate tax than in 2019.

The recent trend has been more dramatic. 50% more people are paying higher rate tax than in 2019.

Here's the higher rate tax band since 1990.

It rose faster than inflation from 1994 to 2009. Then began a steep decline - with many more people paying higher rate.

Here's the higher rate tax band since 1990.

It rose faster than inflation from 1994 to 2009. Then began a steep decline - with many more people paying higher rate.

And our tax calculator is also there. taxpolicy.org.uk/2025/11/12/t...

And our tax calculator is also there. taxpolicy.org.uk/2025/11/12/t...

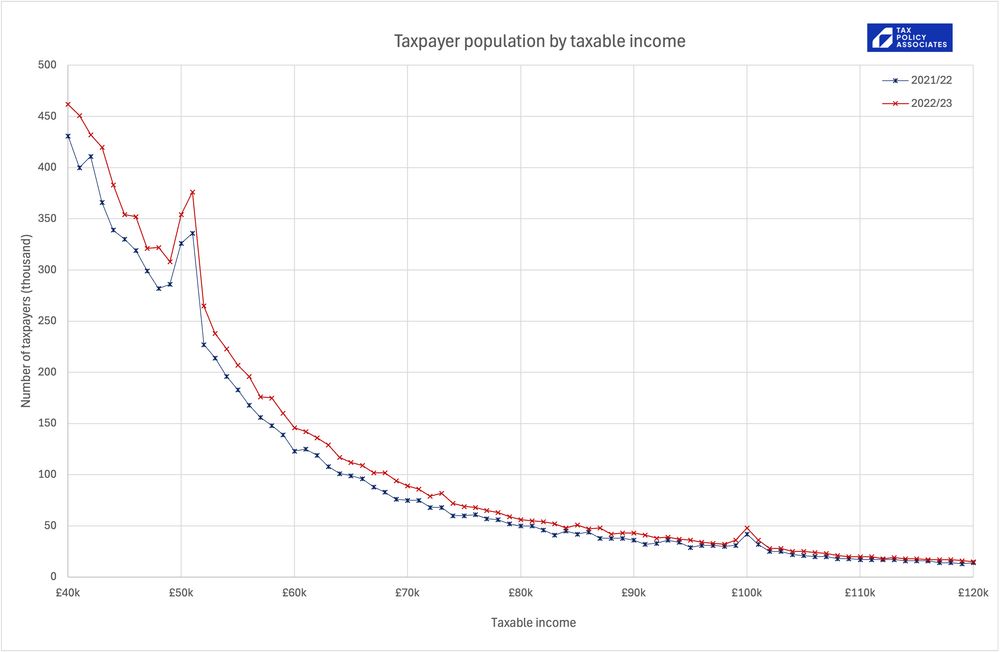

Both bumps will have grown since then. Check out how they grew between 2021/22 and 2022/23:

Both bumps will have grown since then. Check out how they grew between 2021/22 and 2022/23:

And full write-up there.

And full write-up there.

People know this. They make additional pension contributions, turn away work, refuse promotions, work 4 days a week...

People know this. They make additional pension contributions, turn away work, refuse promotions, work 4 days a week...

9% more if they've a student loan

This is from our tax calculator: buff.ly/CFoExUX

9% more if they've a student loan

This is from our tax calculator: buff.ly/CFoExUX

Other calculators just calculate your tax. This one calculates your tax now, and under various Budget proposals. And draws a pretty chart showing the marginal and effective rates for *everyone*.

Other calculators just calculate your tax. This one calculates your tax now, and under various Budget proposals. And draws a pretty chart showing the marginal and effective rates for *everyone*.

Oh, my mistake, that's not a castle - it's the Scottish marginal tax rates.

Oh, my mistake, that's not a castle - it's the Scottish marginal tax rates.

Tomorrow we're launching our Budget tax calculator. Prettier and nerdier than all the rest put together.

Tomorrow we're launching our Budget tax calculator. Prettier and nerdier than all the rest put together.

The video is funny and compelling but makes a bad error. It ignores incentives.

The policy proposed would likely *increase* private jet emissions.

The video is funny and compelling but makes a bad error. It ignores incentives.

The policy proposed would likely *increase* private jet emissions.

The result - people in similarly valuable houses would face a total postcode lottery.

The result - people in similarly valuable houses would face a total postcode lottery.

New analysis from Chaminda Jayanetti at PoliticsHome shows another real source of unfairness...

New analysis from Chaminda Jayanetti at PoliticsHome shows another real source of unfairness...

EU law exempts aircraft fuel from duties unless it's "private pleasure flying"

And in practice most private jet flights are either for business, or (loophole!) rich person pays a commercial rate to fly on a jet owned by their own company.

No duty

EU law exempts aircraft fuel from duties unless it's "private pleasure flying"

And in practice most private jet flights are either for business, or (loophole!) rich person pays a commercial rate to fly on a jet owned by their own company.

No duty