Stories here: https://www.bloomberg.com/authors/AVpmg49A96U/keira-wright

⚡ Latest tender under Capacity Investment Scheme awarded contracts for 4.1GW / 15.4GWh of storage.

⚡ CIS to back 14GW of new clean capacity by 2030.

BNEF sees utility-scale batteries in Australia hitting 20GW by 2035, up from just 3.3GW in July.

⚡ Latest tender under Capacity Investment Scheme awarded contracts for 4.1GW / 15.4GWh of storage.

⚡ CIS to back 14GW of new clean capacity by 2030.

BNEF sees utility-scale batteries in Australia hitting 20GW by 2035, up from just 3.3GW in July.

📉That's just 21% of the total investment in 2024.

I'm curious to hear whether folks this is due to a broad ESG investment pullback or something else?

#Greensky #CircularEconomy

📉That's just 21% of the total investment in 2024.

I'm curious to hear whether folks this is due to a broad ESG investment pullback or something else?

#Greensky #CircularEconomy

The cable will allow coal-reliant areas to tap Tasmania's vast hydro resources, especially at night when rooftop solar generation winds down in the evenings.

Stay tuned for more updates!

The cable will allow coal-reliant areas to tap Tasmania's vast hydro resources, especially at night when rooftop solar generation winds down in the evenings.

Stay tuned for more updates!

www.bloomberg.com/features/202...

www.bloomberg.com/features/202...

$386 billion USD was invested during the first half of 2025 alone, a 10% jump from the same time last year, according to new data from BNEF.

The boom is mainly being driven by fast, small-scale solar.

$386 billion USD was invested during the first half of 2025 alone, a 10% jump from the same time last year, according to new data from BNEF.

The boom is mainly being driven by fast, small-scale solar.

New analysis by BNEF's Tushna Mehta shows the market is already showing signs of slowing -- commissioned capacity in 2025 is expected to be 41% lower than 2023.

New analysis by BNEF's Tushna Mehta shows the market is already showing signs of slowing -- commissioned capacity in 2025 is expected to be 41% lower than 2023.

Credit to my editor @robverdonck.bsky.social who pulled this one together earlier today. It will be interesting to keep an eye on how it changes with so many new projects in the pipeline.

www.bloomberg.com/news/article...

Credit to my editor @robverdonck.bsky.social who pulled this one together earlier today. It will be interesting to keep an eye on how it changes with so many new projects in the pipeline.

www.bloomberg.com/news/article...

The cost of energy tends to swing wildly from the middle of the day when rooftop solar floods the grid, (sometimes pushing prices BELOW zero) to the evening when prices soar.

The cost of energy tends to swing wildly from the middle of the day when rooftop solar floods the grid, (sometimes pushing prices BELOW zero) to the evening when prices soar.

These are some of my favourite charts showing how our energy sector is changing....

First up, we have our huge battery boom. You can read about that here: www.bloomberg.com/news/article...

These are some of my favourite charts showing how our energy sector is changing....

First up, we have our huge battery boom. You can read about that here: www.bloomberg.com/news/article...

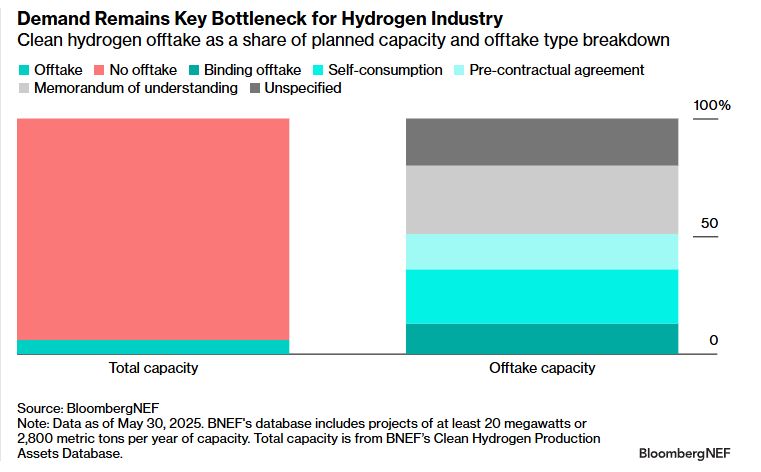

Think steel mills, cement plants and long-distance planes. They need a clean fuel that can be stored and burned, sometimes at high temperatures. This is where green hydrogen comes in.

Think steel mills, cement plants and long-distance planes. They need a clean fuel that can be stored and burned, sometimes at high temperatures. This is where green hydrogen comes in.