📈 Thrive in a world of exponential change

🎙️ New episodes weekly | 🎧 Subscribe now

https://www.youtube.com/@BeingExponential

Bitcoin has pretty convincingly lost the 50-week moving average. Current price of $98,000 is about 5% below the 50-week MA at $103,000.

Bitcoin has pretty convincingly lost the 50-week moving average. Current price of $98,000 is about 5% below the 50-week MA at $103,000.

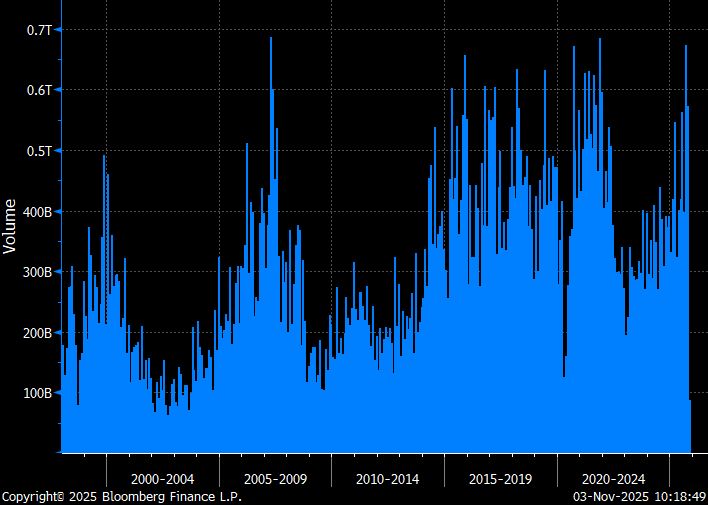

This chart contradicts that fear with hard data.

This chart contradicts that fear with hard data.

- Burry: #META #MSFT #AMZN inflate earnings via GPU life extension

- SoftBank sells #NVDA to fund OpenAI

- OpenAI's potential $1T IPO. #SSSS as proxy investment

- #SITM #COR #LITE blowout earnings

- BTD in #MPWR #NVMI #NBIS after post-earnings selloffs?

- & more

🔗🔽

Oversold + at major technical support.

Looks attractive to me.

Oversold + at major technical support.

Looks attractive to me.

Bounced at some pretty major technical support around $50. Strong earnings. Massive 2-day rally. Dropped into nearly oversold territory on the RSI - now rebounding. Close to triggering a bullish MACD crossover below the zero-line. Retaking the 100-day moving average.

Bounced at some pretty major technical support around $50. Strong earnings. Massive 2-day rally. Dropped into nearly oversold territory on the RSI - now rebounding. Close to triggering a bullish MACD crossover below the zero-line. Retaking the 100-day moving average.

Microsoft wants to change that by leveraging influencers to position Copilot as the "cool" AI assistant.

Microsoft wants to change that by leveraging influencers to position Copilot as the "cool" AI assistant.

Nuclear: #CEG #VST #OKLO #SMR #BWXT #CCJ #TLN

Storage: #BE #EOSE #FLNC

But... but... but...

But... but... but...

- #META, #GOOGL, #AMZN beat earnings but capex concerns

- Fed rate cut unclear, AI still booming

- M&A/IPO surge yellow flag

- BTD in rare earths #MP, nuclear #BWXT, energy storage #BE?

- Crypto stablecoins + tokenization

- Breakouts: #WDC, #BE, #TER, #LUMN, #FORM

🔗🔽

- Revs +104%

- Operating profits +162%

- Q4e revs +75% -> high-growth story

- Revs +104%

- Operating profits +162%

- Q4e revs +75% -> high-growth story

Big deal. Excluding Covid, every single meaningful break below the 50-week moving average in the past has signaled the end of the boom cycle.

Happened in August 2014. Signaled the end of the 2011-14 boom cycle.

Big deal. Excluding Covid, every single meaningful break below the 50-week moving average in the past has signaled the end of the boom cycle.

Happened in August 2014. Signaled the end of the 2011-14 boom cycle.

Strong beat-and-raise Q3 report that included 7% rev growth + 11% defense revenue growth w/ a 17% jump in the order backlog to nearly $50B.

Strong beat-and-raise Q3 report that included 7% rev growth + 11% defense revenue growth w/ a 17% jump in the order backlog to nearly $50B.

But it is not a rising-tide-lifts-all-boats dynamic.

But it is not a rising-tide-lifts-all-boats dynamic.

M&A volume is one of the contrarian indicators I'm watching for a market top. It is picking up.