https://pythonfintech.com/

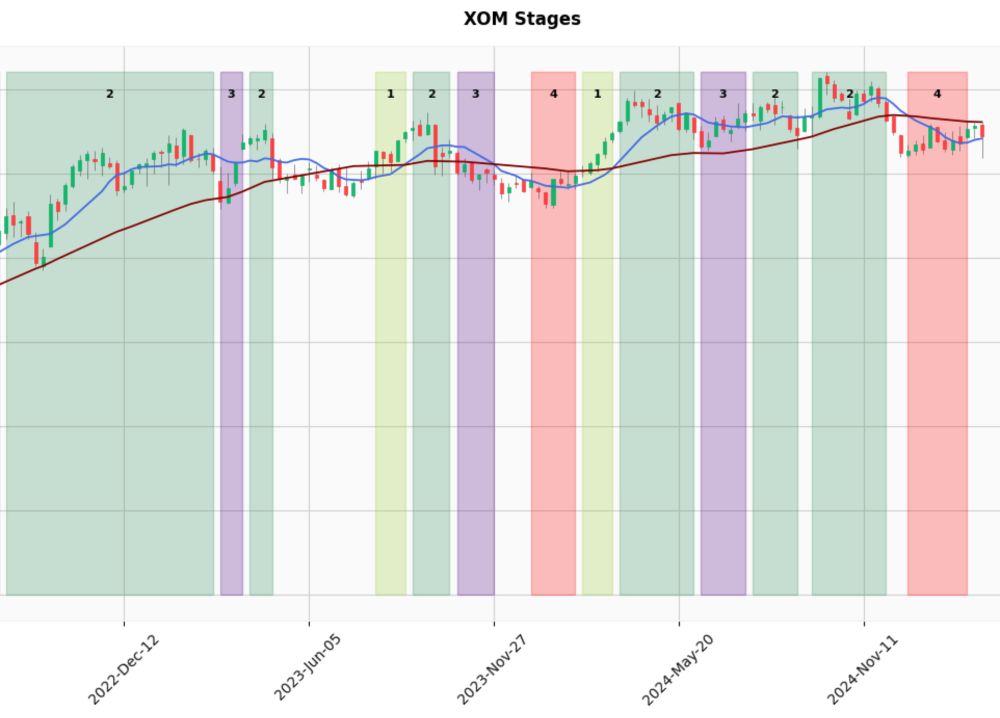

The implementation I cover here tries to mimic the output you see in TradingView (as much as possible).

👉 pythonfintech.com/articles/tra...

#Python #DataScience #Quant #AlgoTrading #Finance

The implementation I cover here tries to mimic the output you see in TradingView (as much as possible).

👉 pythonfintech.com/articles/tra...

#Python #DataScience #Quant #AlgoTrading #Finance

👉 pythonfintech.com/articles/mar...

#Python #DataScience #Quant #AlgoTrading #Finance

👉 pythonfintech.com/articles/mar...

#Python #DataScience #Quant #AlgoTrading #Finance

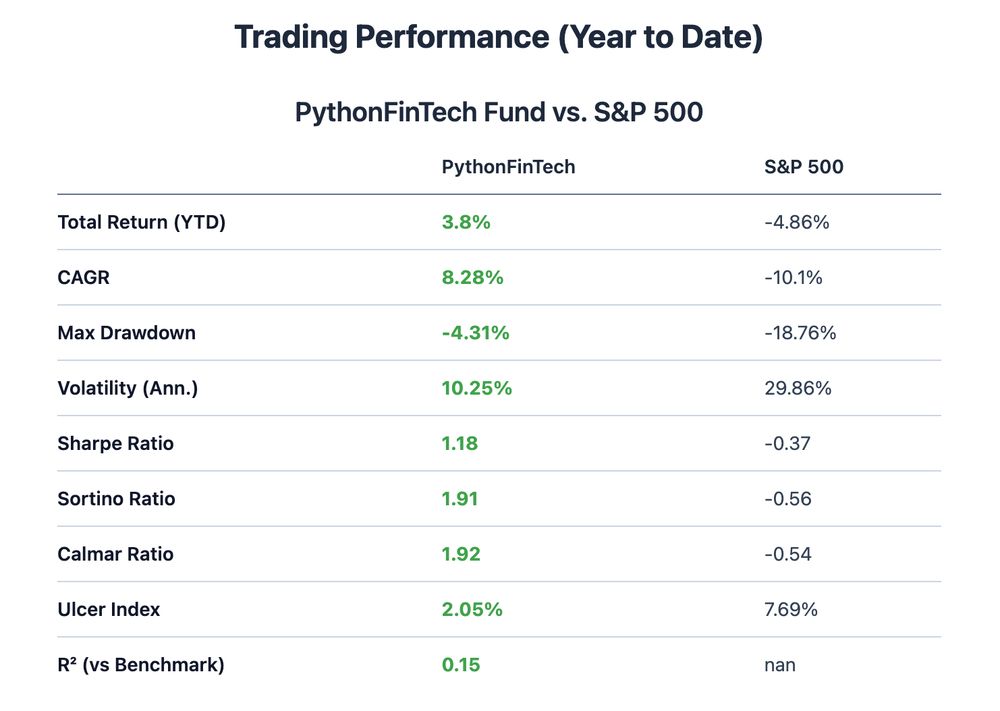

✅ +3.8% YTD (vs. S&P -4.86%)

🛡️ Max Drawdown: -4.3%

⚖️ Sharpe 1.18 | Sortino 1.91 | Calmar 1.92

🌀 Volatility: 10.25% vs. 29.86%

📉 R² = 0.15

Staying patient and tactical.

#FinTech #Quant #Finance #AlgoTrading #PortfolioManagement

✅ +3.8% YTD (vs. S&P -4.86%)

🛡️ Max Drawdown: -4.3%

⚖️ Sharpe 1.18 | Sortino 1.91 | Calmar 1.92

🌀 Volatility: 10.25% vs. 29.86%

📉 R² = 0.15

Staying patient and tactical.

#FinTech #Quant #Finance #AlgoTrading #PortfolioManagement

As a trader, keeping an eye on sector rotation can help you spot market shifts and trends before the rest of the market.

#Python #DataScience #Quant #AlgoTrading #Finance

As a trader, keeping an eye on sector rotation can help you spot market shifts and trends before the rest of the market.

#Python #DataScience #Quant #AlgoTrading #Finance

Here's another little tutorial I put together.

Hope you enjoy it ✌️

pythonfintech.com/articles/com...

#Python #DataScience #Pandas

Here's another little tutorial I put together.

Hope you enjoy it ✌️

pythonfintech.com/articles/com...

#Python #DataScience #Pandas

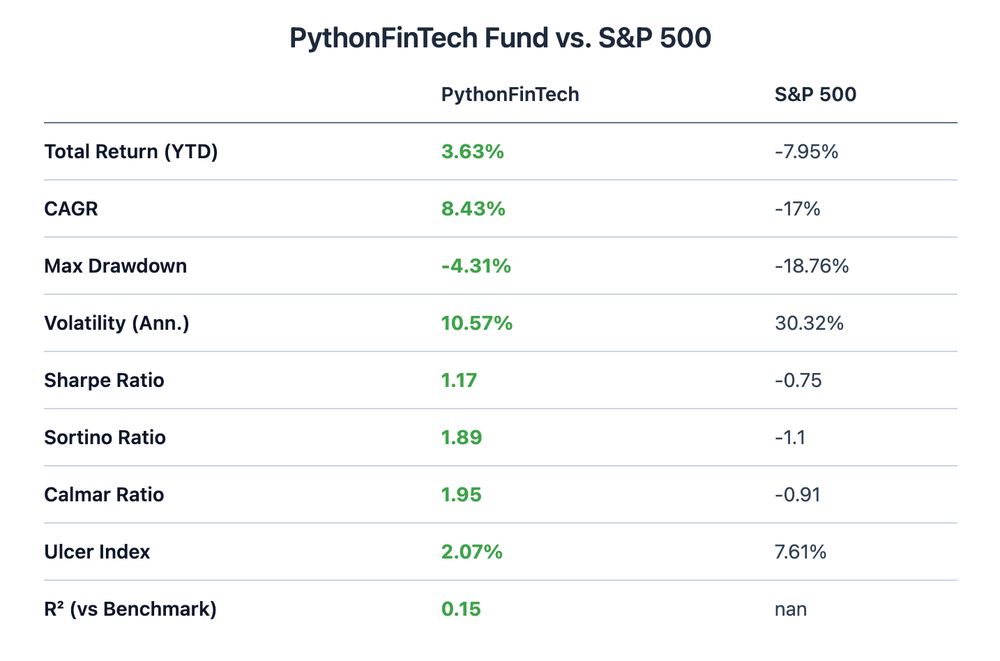

📈 Outperforming S&P 500 by ~11%

🧠 Low drawdown

⚖️ High risk-adjusted return

🔍 Very little correlation to S&P 500 (strategy is hunting idiosyncratic alpha, not riding the market beta wave)

#FinTech #Quant #AlgoTrading #Finance

📈 Outperforming S&P 500 by ~11%

🧠 Low drawdown

⚖️ High risk-adjusted return

🔍 Very little correlation to S&P 500 (strategy is hunting idiosyncratic alpha, not riding the market beta wave)

#FinTech #Quant #AlgoTrading #Finance

pythonfintech.com/articles/con...

#Python #Programming

pythonfintech.com/articles/con...

#Python #Programming

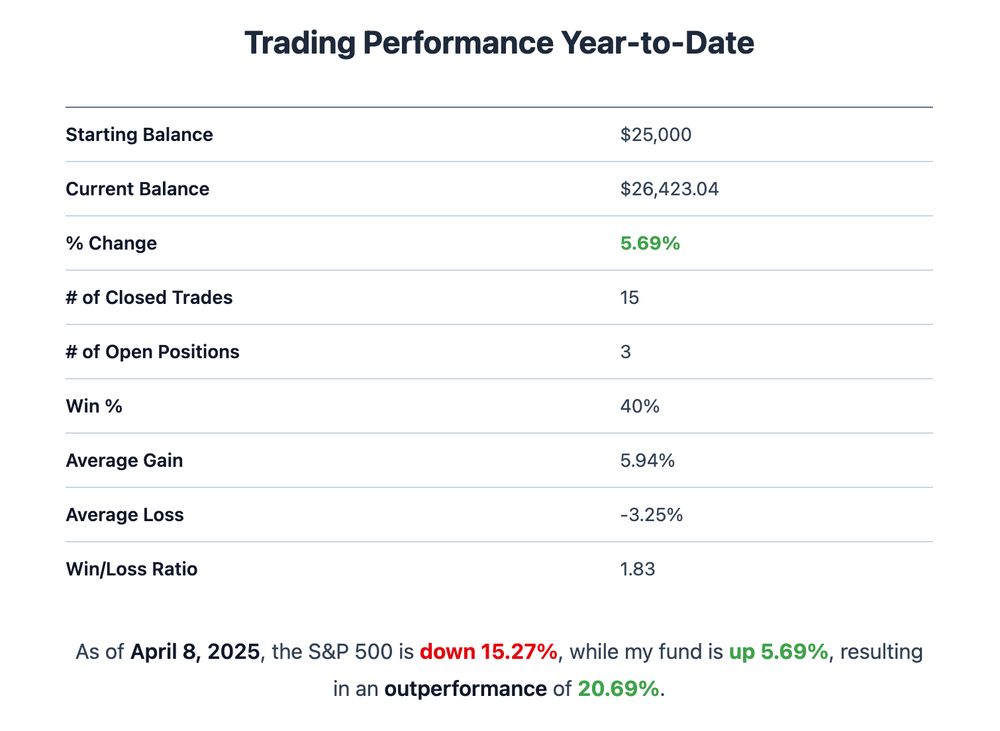

pythonfintech.com/articles/cas...

(All metrics as of 8 April 2025, the day I drafted this article)

#fintech #quant #finance #algotrading #markets

pythonfintech.com/articles/cas...

(All metrics as of 8 April 2025, the day I drafted this article)

#fintech #quant #finance #algotrading #markets

• S&P 500: -15.27% 📉

• My Portfolio: +5.69% 📈

• Edge: +20.69% 🚀

#fintech #quant #finance #algotrading #markets

• S&P 500: -15.27% 📉

• My Portfolio: +5.69% 📈

• Edge: +20.69% 🚀

#fintech #quant #finance #algotrading #markets

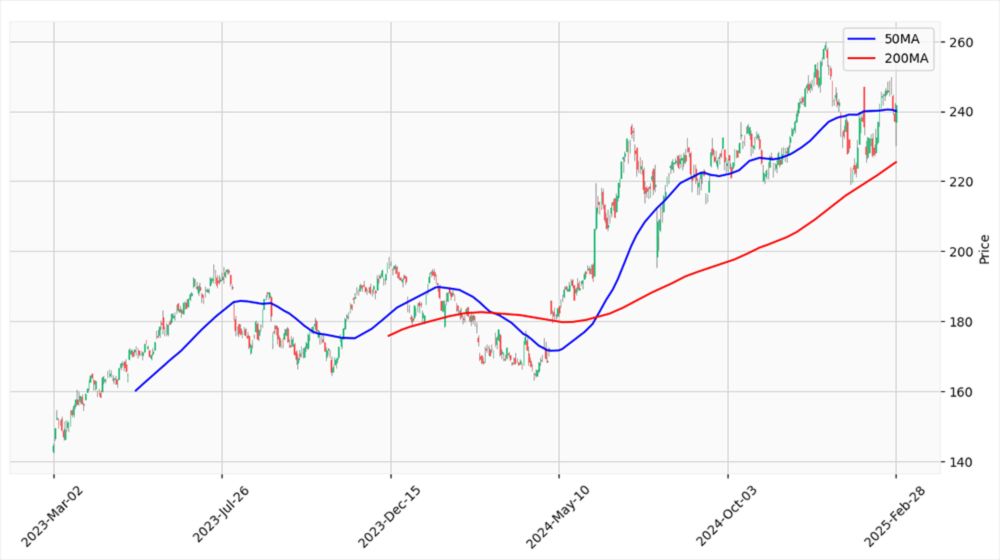

Learn to:

- Calculate SMAs across multiple timeframes

- Visualize MAs with candlestick charts

- Identify golden/death crosses

- Apply to any ticker with clean code

👉 pythonfintech.com/articles/com...

#Python #Trading #AlgoTrading

Learn to:

- Calculate SMAs across multiple timeframes

- Visualize MAs with candlestick charts

- Identify golden/death crosses

- Apply to any ticker with clean code

👉 pythonfintech.com/articles/com...

#Python #Trading #AlgoTrading

- Creating proper candlestick charts

- The anatomy of a candlestick

- Adding volume data for deeper market insights

- Focusing analysis on recent price movements

pythonfintech.com/articles/plo...

#Python #Trading #Quant #AlgoTrading

- Creating proper candlestick charts

- The anatomy of a candlestick

- Adding volume data for deeper market insights

- Focusing analysis on recent price movements

pythonfintech.com/articles/plo...

#Python #Trading #Quant #AlgoTrading

2 tickers = 10 columns

100 tickers = 500 columns 🙄

I prefer a row-based index

- Always 5 columns (OHLCV)

- Easier indicator calculations

- Debuggable without eyestrain

pythonfintech.com/articles/ret...

#Python #DataScience #Trading

2 tickers = 10 columns

100 tickers = 500 columns 🙄

I prefer a row-based index

- Always 5 columns (OHLCV)

- Easier indicator calculations

- Debuggable without eyestrain

pythonfintech.com/articles/ret...

#Python #DataScience #Trading

Just published my first tutorial since selling PyImageSearch—now it's Python for trading.

Learn how to download market data with yfinance:

pythonfintech.com/articles/how...

#Python #FinTech #Trading #Quant #FinTech

• S&P 500: -1.35% 📉

• My Portfolio: +1.53% 📈

• Edge: +2.87% 🚀

How? I went to cash when others bought the dip.

Sometimes the best trade is no trade at all.

Full breakdown: 👇

pythonfintech.com/articles/feb...

#trading #fintech #quant #finance

• S&P 500: -1.35% 📉

• My Portfolio: +1.53% 📈

• Edge: +2.87% 🚀

How? I went to cash when others bought the dip.

Sometimes the best trade is no trade at all.

Full breakdown: 👇

pythonfintech.com/articles/feb...

#trading #fintech #quant #finance

From HFT (where humans need not apply) to Buffett-style investing, I break down which trading style matches different personalities.

My pick? Swing trading with Python automation

pythonfintech.com/articles/typ...

#quant #fintech #trading

From HFT (where humans need not apply) to Buffett-style investing, I break down which trading style matches different personalities.

My pick? Swing trading with Python automation

pythonfintech.com/articles/typ...

#quant #fintech #trading

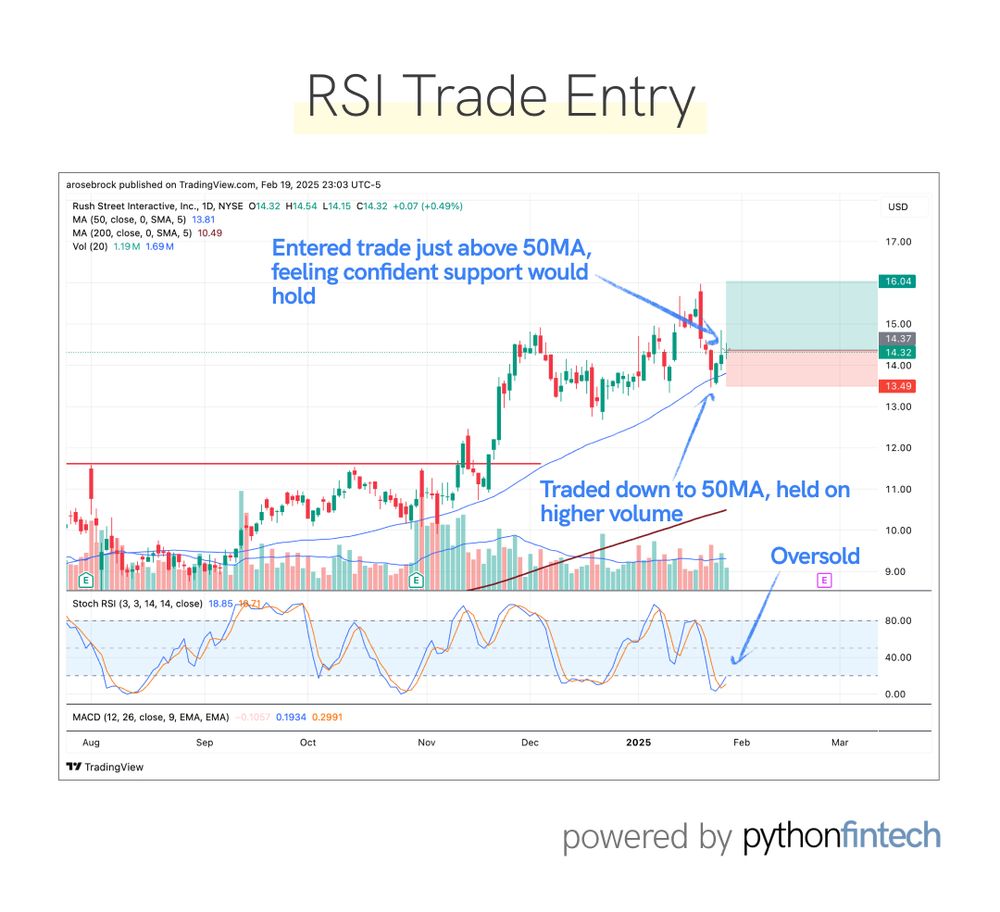

- Hammer candle off 50-day MA

- Oversold Stochastics

- Higher volume on advances

- Clear path to $18

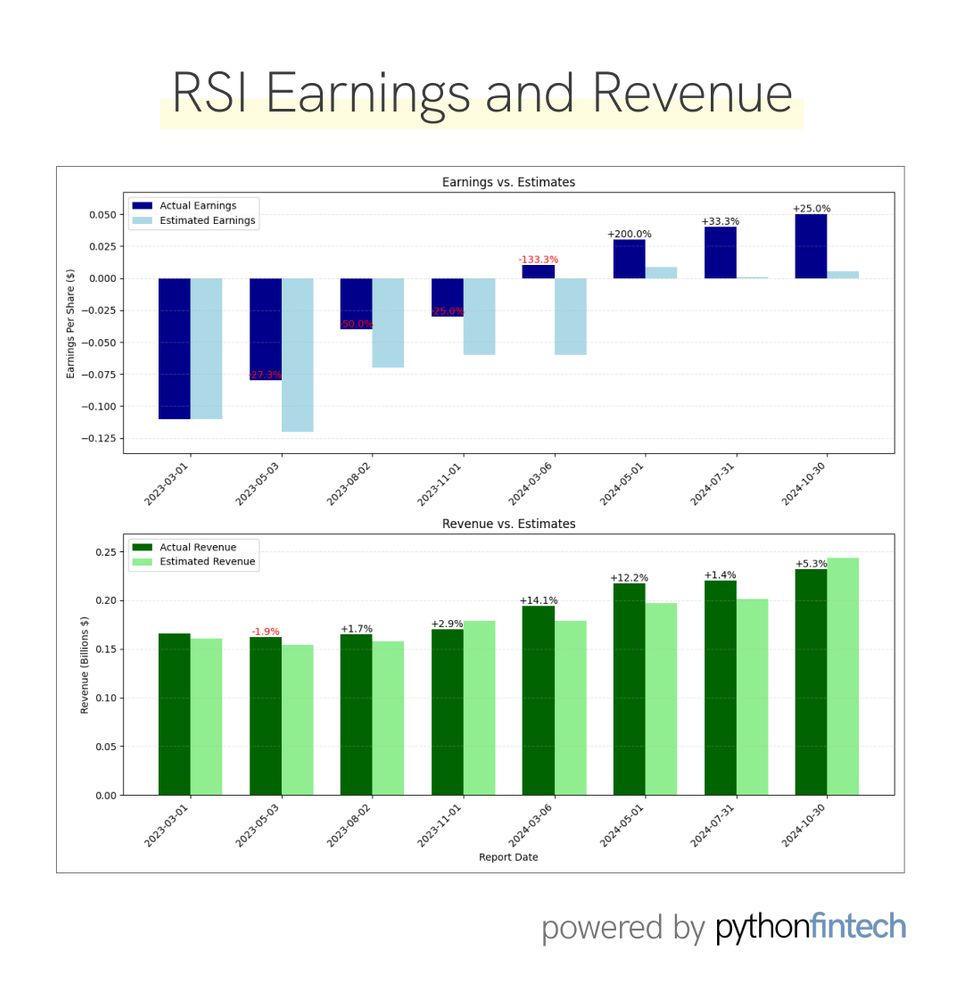

- 225% earnings beat average

- 800% earnings growth expected Wednesday

Already up 1.87R, looking to add to position

#fintech #algotrading #quant #trading

- Hammer candle off 50-day MA

- Oversold Stochastics

- Higher volume on advances

- Clear path to $18

- 225% earnings beat average

- 800% earnings growth expected Wednesday

Already up 1.87R, looking to add to position

#fintech #algotrading #quant #trading

Yeah, this is one of those stories.

Learn from my mistakes here:

👉 pythonfintech.com/articles/pro...

#fintech #algotrading #quant #trading #python

Yeah, this is one of those stories.

Learn from my mistakes here:

👉 pythonfintech.com/articles/pro...

#fintech #algotrading #quant #trading #python

- Starting Balance: $25,000

- Current Balance: $25,928.09

- % Change: 3.71%

- # of Trades: 2

- Win %: 50%

- Average Gain: 17.38%

- Average Loss: -2.94%

- Win/Loss Ratio: 5.9

#fintech #algotrading #quant #trading #python

- Starting Balance: $25,000

- Current Balance: $25,928.09

- % Change: 3.71%

- # of Trades: 2

- Win %: 50%

- Average Gain: 17.38%

- Average Loss: -2.94%

- Win/Loss Ratio: 5.9

#fintech #algotrading #quant #trading #python

#fintech #algotrading #quant #trading #python

#fintech #algotrading #quant #trading #python

The numbers (YTD):

- PythonFinTech: +3.37%

- S&P 500: +2.94%

- Outperformance: 0.43%

Full breakdown of my trades (including what worked and what definitely didn't) here:

👉 pythonfintech.com/articles/jan...

#fintech #algotrading #quant #trading #python

The numbers (YTD):

- PythonFinTech: +3.37%

- S&P 500: +2.94%

- Outperformance: 0.43%

Full breakdown of my trades (including what worked and what definitely didn't) here:

👉 pythonfintech.com/articles/jan...

#fintech #algotrading #quant #trading #python

#NVDA and #AVGO took massive hits this past week.

Time to go shopping for oversold stocks:

👉 pythonfintech.com/articles/cel...

#Python #FinTech #algo #quant #trading #market